german tax calculator for married couples

Calculate your German freelancer taxes profit and loss income taxes as well as Ehegattesplitting. In case John and Mary choose Couple Taxation the taxable income is 75000 EUR 9168 EUR x 2 roughly 13000 EUR social security contribution 40000 EUR and the resulting tax.

Income Tax In Germany Simply Explained By Perfinex

This German tax calculator allows you to calculate income tax even.

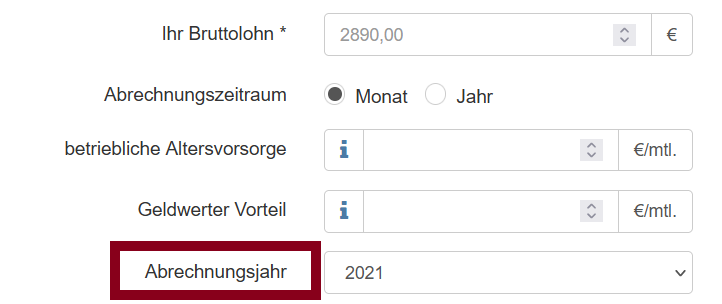

. German Wage Tax Calculator This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. The median income tax rate is. The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year.

From January 2021 however the solidarity tax will only be applied to income from taxpayers who earn more than 62127 124255 for married couples per year. Its a progressive tax. Married couple with two dependent children under age 18 years.

Income Gross salary of one spouse of EUR 100000. If you earn more you pay a bigger percentage of your income. Calculate your Gross Net Wage - German Wage Tax Calculator Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany.

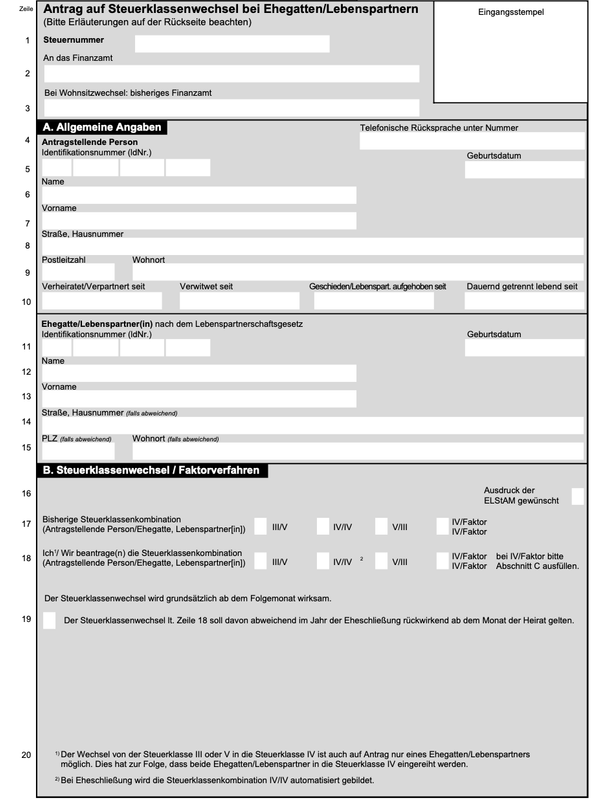

To the wage tax calculator Tax class selection for married couples. With Ehegattensplitting married or partnered. German Freelance Tax Calculator.

This Wage Tax Calculator is best. You can see Germanys progressive tax rates in action here. Notice the 0 tax rate for all individuals earning less than 10347.

With our net wage calculator you can calculate your net income after deducting all social security contributions and taxes. This is a sample tax calculation for the year 2021. If you earn less than 10347 per year you dont pay income tax.

Church tax of EUR 1205 wage church tax. The married couple must have resided together in Germany up until that point in time. The calculator below can help estimate the financial impact of filing a joint tax return.

If you want to check your individual income then use this German tax calculator for married couples and civil partners. Then from 10348 all the way up to 58596 it scales. The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year.

Marriage has significant financial implications for the individuals involved including its impact on taxation. For married couples the same formula is used but with the difference that for only the. 18014 a savings of 1715 per year.

Married couples and registered civil partners. The calculator below can help estimate the financial.

Tax Declaration Handbook Germany

Salary Calculator Germany 2022 User Guide Examples Gsf

How To Change Your Tax Class In Germany Jetztpat

Income Tax In Germany For Foreigners Academics Com

Your Bullsh T Free Guide To Taxes In Germany

Mandatory Tax Filing Who S Obligated To File Tax Returns Taxfix

Salary Calculator Germany This Is How Much Net Income You Will Earn Sib

Tax Calculator Germany Salary After Tax

Salary Calculator Germany 2022 User Guide Examples Gsf

Crypto Tax Guide Germany 2022 Kryptowahrung Steuer 2022 Koinly

Your Bullsh T Free Guide To Taxes In Germany

German Tax System Expatrio Com

Income Tax Calculator Budget 2023 Pwc Ireland

Joint Taxes In Germany 2022 Ehegattensplitting Explained

Calculate Your Taxes In Germany Immigrant Spirit